How To Spend Bitcoin On Cash App

Posted : admin On 3/25/2022First you have to download the Cash App from the Android or Apple app store. Download Here

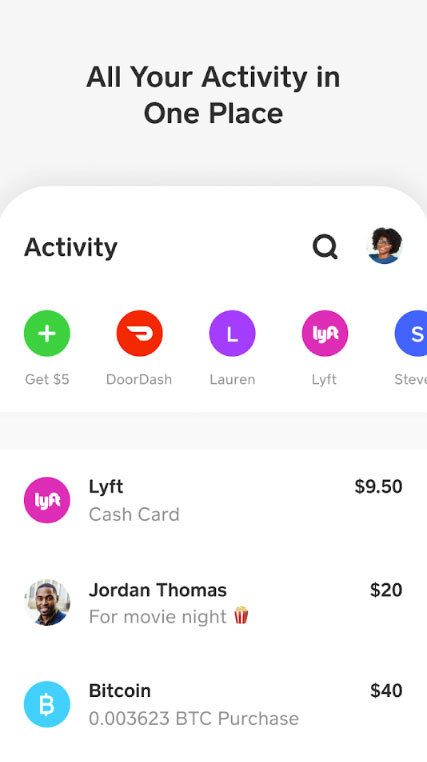

If you receive money, it lands in your Cash App account. Or you can link Cash App to an existing bank account and use that to transfer money to and from the Cash App account. You can also send money from a debit card and spend your Cash App balance directly from that. The Cash App has a new feature, introduced in early 2018, that makes buying and selling Bitcoin as easy as paying your friend for pizza. While buying and selling bitcoin is available in other bitcoin related apps, Cash app is a widely used consumer oriented app that has been updated to allow Bitcoin trading.

To Buy Bitcoin (BTC) in Cash App:

Cash App is the fastest way to spend Bitcoin in the U.S. In Europe, Coinbase has a debit card that allows you to choose between a variety of coins and spend them. Unfortunately, this is not allowed yet in the United States, and no other crypto exchange offers allows users to manage cash as closely to Bitcoin as Cash App does. You now know how to cash out Bitcoin using a P2P exchange. Once you become more experienced with Local Bitcoins, you can practice selling using different payment methods. The good thing is, some payment methods allow you to sell your Bitcoins at a higher price — so it’s worth getting used to. Top 6 Ways To Spend Bitcoins: That said, let’s start with the list 1. Buy Giftcards of popular services. If you have been wondering where do you spend Bitcoin for the right purpose, well you could use it at Bitrefill. Bitrefill is a popular service that sells Giftcards for all popular services.

1. Open your Cash App, select Cash & BTC or the dollar amount at the top of your screen.

2. You can swipe left or select the BTC symbol in the upper right-hand corner.

3. Select Buy, you can use the slider or swipe up to enter the amount you’d like to purchase. Press Buy BTC.

4. Enter your Cash pin or use your Touch ID for security. Press Confirm.

Note: Before you can purchase Bitcoin (BTC) Cash App will pull money into your balance. They may require you to enter some additional identification information.

To Sell Your Bitcoin (BTC) in Cash App:

1. Open your Cash App, select Cash & BTC or the dollar amount at the top of your screen.

2. You can swipe left or select the BTC symbol in the upper right-hand corner.

3. Select Sell, you can use the slider or swipe up to enter the amount you’d like to sell. Press Sell BTC.

4. Enter your Cash pin or use your Touch ID for security. Press Confirm.

FAQ

How much does buying and selling Bitcoin cost?

Cash App does not charge an additional percentage or fixed dollar amount. They use a price calculated from the quoted mid-market price, inclusive of a margin or speed. The mid-market price is a combined price of BTC across major exchanges to give the user an average price.

Note: When you buy Bitcoin (BTC) from Cash App, the margin may differ from when you sell Bitcoin (BTC) to Cash App. The price and margin may also be different from other exchanges/marketplace.

Can you send Bitcoin (BTC) to an External Wallet?

Yes! To withdraw your Bitcoin to an external wallet follow the steps below:

- Open your Cash App, Select the profile icon in the upper-left.

- Scroll to Funds and Select Bitcoin.

- Before you can withdraw your funds, you will need to verify your Identity.

- Once you’ve verified your identity, Select “Transfer Out” and Press Confirm.

- Scan the QR code from your external wallet or select “Use Wallet Address” at the bottom of your screen.

- Press Confirm.

Note: Once you’ve processed your withdrawal in Cash App, your Bitcoin (BTC) will be sent to your external wallet. Transfering Bitcoin (BTC) can take time, so please allow up to a few hours for the transfer to complete.

You may like

The United States passed into law its Anti-Money Laundering Act of 2020, which takes effect on January 1, 2021. This brings digital currency exchange companies and other digital-asset-related businesses under the scope of regulations of the Bank Secrecy Act (BSA), which requires financial institutions “to actively detect, monitor and report potential money laundering activity.”

“I’m pleased that our anti-money laundering legislation was included as a part of this year’s [National Defense Authorization Act]. This bipartisan legislation protects Americans by depriving criminals and terrorists of the tools they use to finance illicit activity. It is the first serious overhaul of our anti-money laundering system in decades, and it makes sense to include it in the biggest, most important national defense legislation Congress passes each year,” South Dakota Sen. Mike Rounds said in a press release.

The massive anti-money laundering reforms are targeting businesses dealing with digital currencies and assets by clearly specifying the definition of a “financial institution” to “‘a business engaged in the exchange of currency, funds, or value that substitutes for currency or funds” and “a licensed sender of money or any other person who engages as a business in the transmission of funds or value that substitutes for currency.”

The reforms further define a “money transmitting business” to include those who deal with “currency, funds, or value that substitutes for currency.” Now, there are no longer loopholes that digital asset companies can use when dealing with the Financial Crimes Enforcement Network (FinCEN), the agency that enforces the BSA.

Stricter Penalties Enforced

Aside from updating definitions to ensure that digital currency exchange firms and others dealing in digital assets are clearly within the scope of the AML Act of 2020 and the BSA, stricter penalties are now being enforced for crypto criminals.

Now, those who have been found guilty of violating the AML Act of 2020 and/or BSA are faced with fines amounting to profits earned while committing the violation and possible jail time. Those guilty of an “egregious” breach are also going to be banned from taking a board member position of any financial institution in the country for 10 years. Furthermore, employees of financial institutions who commit these crimes will be obligated to return to their employer all bonuses received during the time the act was committed.

FinCEN is being given additional resources, like increasing its manpower, to ensure the enforcement of these reforms. This will further safeguard investors against crypto crimes and nail down digital currency exchange firms and other digital-asset-related businesses that do not comply with BSA regulations.

Less than two months into 2021, the price of bitcoin has risen 95.4%.

How To Send Bitcoin On Cash App

Based in the United States and want to trade via Binance.US? Click here to sign up now!

Charles Hoskinson has always been a huge advocate for decentralized finance and building a network that could provide solutions to the problems with our current financial and banking systems. In this recent AMA Charles speaks out on his view about the issues that Bitcoin faces as well as reminding everyone that cryptocurrency isn’t all about taking profits.

Despite Charles Hoskinson open criticisms of Bitcoin he does say: